Borrow rate calculator

The above definition of the incremental borrowing rate has changed from ASC 840. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

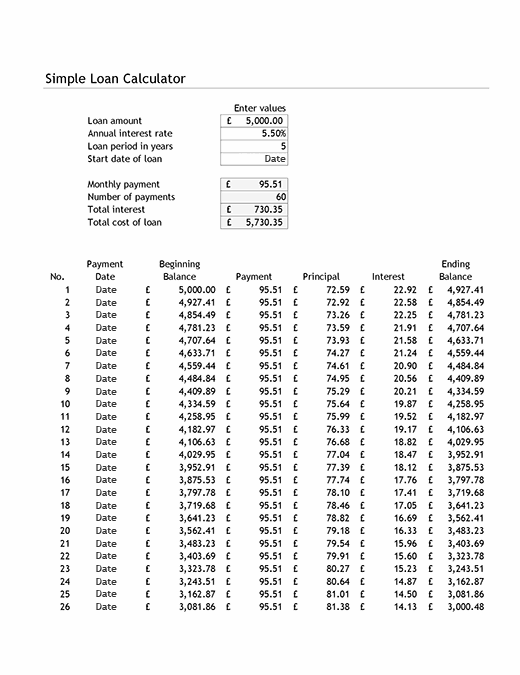

Loan Calculator That Creates Date Accurate Payment Schedules

Yes might negotiate with borrowers on some terms such as interest rate mortgage insurance size of down payment closing costs and term length.

. The Loan term is the period of time during which a loan must be repaid. Youll be charged with a daily stock borrow fee based on a stocks price and its availability. Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule.

For example a 30-year. Fill in the entry fields. An interest rate is a percentage that is charged by a lender to a.

Market price of stock x 102 Per Share Collateral Amount. Choose a borrowing solution thats right for you. Are assessing your financial stability ahead of.

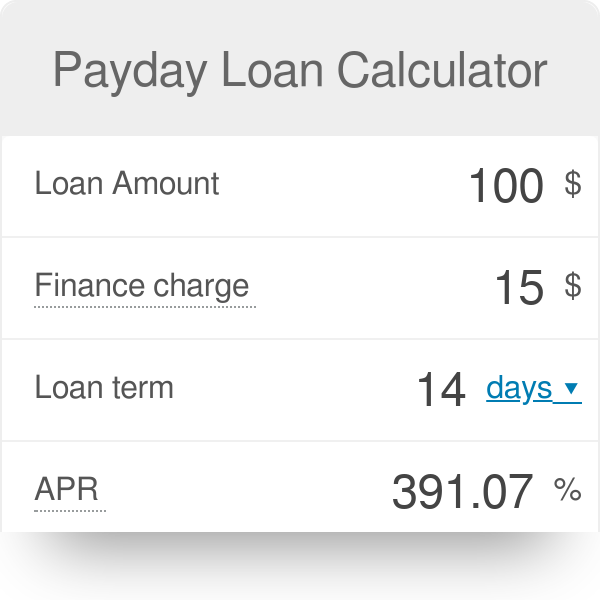

Want to know exactly how much you can safely borrow from your mortgage lender. Interest is accrued daily and charged as per the payment frequency. This basic APR Calculator finds the effective annual percentage rate APR for a loan such as a mortgage car loan or any fixed rate loan.

This mortgage calculator will show how much you can afford. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. As part of an.

Use our interest rate calculator to work out the interest rate youre receiving on credit cards loans mortgages or savings. How the borrowing power calculator works To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. To use the calculator enter the beginning balance of your loan and your interest rate.

The APR is the stated interest rate of the loan. Next you take the per share collateral amount. 55 APR Representative based on a.

How to use our calculator Choose how much you want to save or. Borrowing and savings calculator Use our interest rate calculator to see how interest rates affect borrowing and saving. For more information about or to do.

But ultimately its down to the individual lender to decide. Here is an example. The step-by-step hard-to-borrow fee calculation looks like this.

Finally in the Interest rate box enter the rate you expect to pay. Next add the minimum and the maximum that you are willing to pay each month then click calculate. The Maximum Mortgage Calculator is most useful if you.

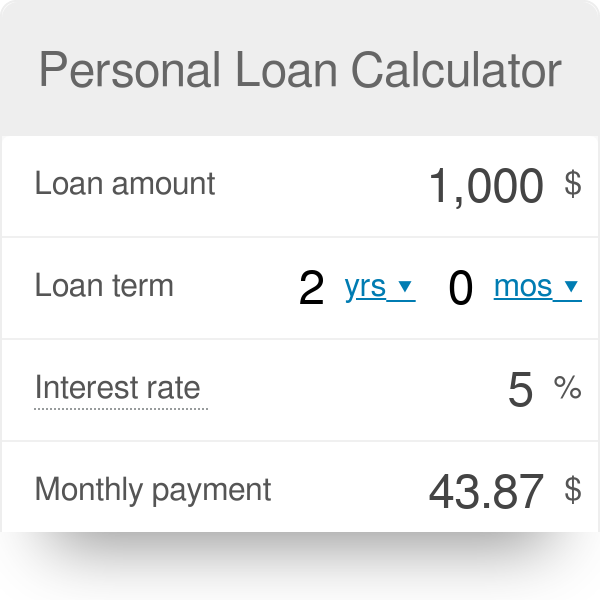

Loan calculator MoneySuperMarkets loan calculator is designed to give you an idea how much a personal loan is going to cost. Previously the incremental borrowing rate was the rate that at lease inception a lessee. Calculation results are approximations and for information purposes only.

30547814 Total Interest Paid 20000 Monthly Tax Paid 7200000 Total Tax Paid 8333 Monthly Home Insurance 3000000 Total Home Insurance 2424927 Annual Payment. Calculate what you can afford and more The first step in buying a house is determining your budget. Hard-to-borrow HTB means that the supply is limited for short selling.

Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the Interest Calculator.

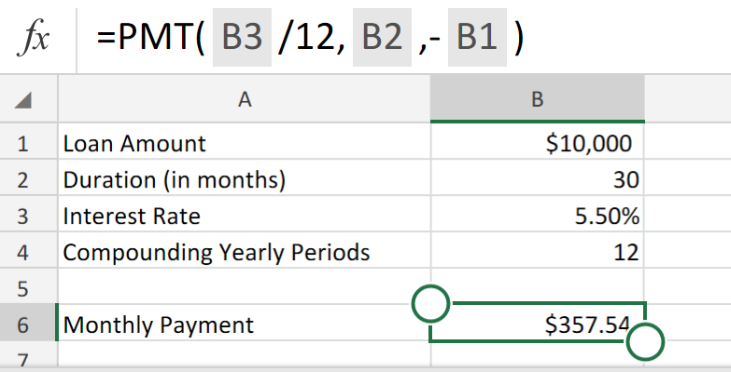

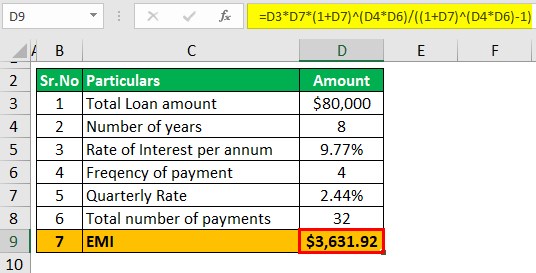

Excel Formula Calculate Interest Rate For Loan

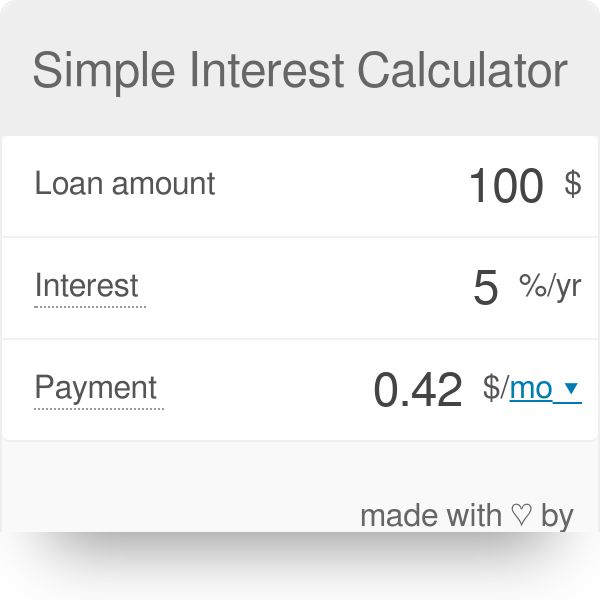

Simple Loan Calculator And Amortisation Table

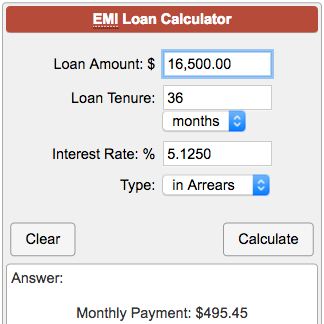

Emi Loan Calculator

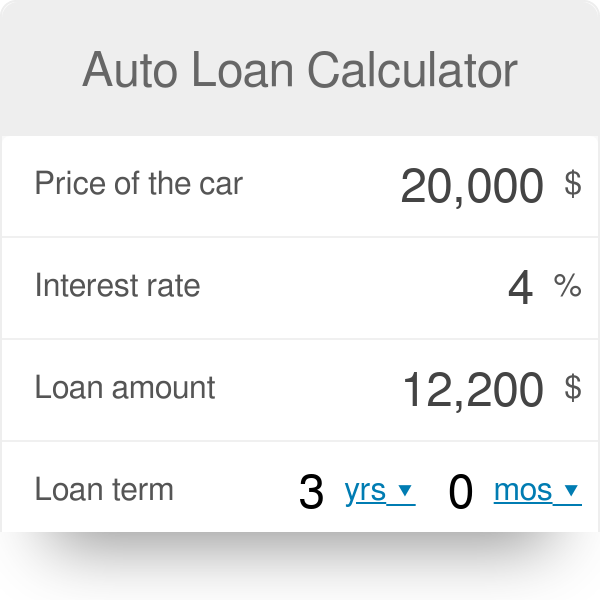

Auto Loan Calculator

Hard To Borrow Fee Calculation Ally

Payday Loan Calculator

Advanced Loan Calculator

Excel Formula Calculate Interest Rate For Loan Exceljet

Hard To Borrow Fee Calculation Ally

Floating Interest Rate Formula And Variable Pricing Calculator Excel Template

Personal Loan Calculator Student Loan Hero

Business Loan Calculator Step By Step Guide Examples

Simple Loan Calculator

Simple Interest Calculator Defintion Formula

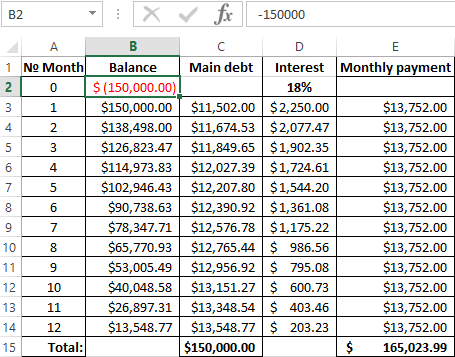

Calculation Of The Effective Interest Rate On Loan In Excel

Personal Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz